Understanding Leverage - What is it, and Why is it Used?

Leverage is everywhere, and plays a role in nearly all business ventures...

Leverage is like a shadow - it’s present in virtually everything you do, but typically goes unnoticed and is rarely thought about in your day-to-day life. Even so, the majority of businesses (and individuals) employ leverage in order to access investment opportunities they couldn’t otherwise afford, and also to magnify the returns of those investments. Leverage is also the lifeblood of the private credit industry - “credit” referring to borrowed money, and “private” referring to the private companies that are typically the borrowers of that money. So for today’s post, given the central theme of leverage in all things private credit, let’s jump into a deep dive of the topic.

In this post, we will explore the significance of leverage from both a private credit and private equity perspective, the correlation between risk and return, and the impact that leverage can have on equity (and credit!) returns. If you find today’s post helpful, consider subscribing (it’s free!) to never miss future posts. If you’re already a subscriber, consider upgrading to paid in order to support our team and ensure we continue to bring you high quality coverage.

Quick sidebar - if you’re ever lost during this article, refer to our latest post 50 Terms you Must Know as a Credit Investor. Hopefully that resource can clear things up. If not - let us know! We’re always looking to do deep dives on topics that our readers find useful. Let’s begin…

The Use of Leverage in Private Equity

In the context of private equity, leverage involves raising debt capital from creditors in order to finance new investments - whether that’s acquiring a new business (platform investment), or facilitating M&A transactions for existing investments (add-ons). Typically, the capital structure could look something like this.

This capital structure contemplates 4.0x turns of senior leverage, and an additional 1.5x turns of mezzanine debt. The 5.5x multiple is the sum of both, and writing it as a cumulative figure is typical in the industry as you move through the capital structure. You might say the First Lien Term Loan “detaches” at 4.0x and the mezzanine debt “detaches” at 5.5x (meaning turns of EBITDA). On the equity side, this contemplates the buyer writing a $343 million equity check (there are often other investors in the equity, but let’s keep it simple for now). After all these investments are committed, the $618.0 million of required funds are raised, and the transaction has the necessary financing to close.

But what if leverage didn’t exist? How could this deal be financed? Below is an alternate “debt-free” capital structure, and it doesn’t look pretty.

The main difference here is that the buyer’s equity check has nearly doubled - from $343 million to the full $618 million requirement. That’s a whole lot of additional dollars that a buyer would need to write to finance the exact same deal as scenario #1. You might say it’s not a huge issue - if they like the deal, why not take more of it? The answer lies in the returns - let’s take a look. The returns below assumes the company is held for 5 years, and EBITDA grows to $90.0 million. Due to the company’s increased scale, the purchase price multiple increases to 14.0x as the company enters a new universe of buyers (i.e. buyers targeting a $1+ billion EV, but refuse to invest in smaller companies).

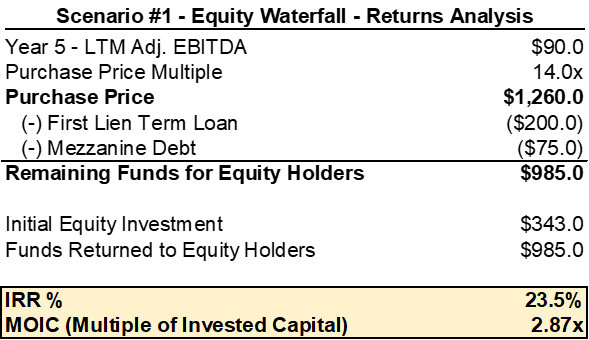

We start at the new purchase price when the company is sold, and work the proceeds down through the capital structure. First, the debtholders are paid. Finally, equity gets their proceeds. In scenario #1 where leverage is employed, the IRR is 23.5% and MOIC is 2.87x - a healthy return on investment.

Now let’s see scenario 2, with the same hold period and growth assumptions as the above.

In the all equity scenario, IRR is 15.3% and MOIC is 2.04x. While still a reasonable return, remember that this is the exact same deal - and using leverage warrants a 8%+ premium to the all-equity solution. Private equity is competitive - and returns matter. That 8% of annual return can be a world of difference in terms of receiving new LP commitments, and competing with other PE shops for new fundraising dollars.

That’s the (somewhat basic) gist of it on the equity side - but what about a less-rosy outcome where EBITDA doesn’t grow, but declines instead? Let’s assume EBITDA declines so significantly that the company is worth a whole let less than what it was acquired for and the equity is wiped out. In scenario #1, The equity holders lose their full $343 million investment. In scenario #2, equity holders lose their full $618 million investment. That’s a $260+ million difference in terms of dollars at risk from the equity holder’s perspective. (Disclaimer: this is a bit of an oversimplification for ease of explanation. If there was no debt on the balance sheet, it’s unlikely that the equity will be fully wiped out. They would either receive whatever proceeds from a sale they can muster, or sell assets similar to creditors. If there was debt on the balance sheet, those proceeds would go to debtholders first, resulting in the equity wipe).

The takeaway is that it’s a bit of a dance - from the equity perspective, using leverage has the potential to amplify returns and reduce dollars at risk. But remember that employing leverage also increases the risk of the investment - if things go south, creditors will jump in and take control, leaving equity holders out in the cold. The right use of leverage to amplify returns without taking unnecessary risk is the delicate dance that is played in the private equity industry by buyers, sellers, lenders - nearly all players.

The Use of Leverage in Private Credit

Now let’s touch on how leverage is employed in private credit. I know what you’re thinking - isn’t it obvious? Private credit is extending the credit, they are the leverage! But the industry is clever, and credit funds also want the benefit of increased returns (maybe they got jealous seeing those eye-watering 8% premiums we walked through above going to the equity holders). So to compensate, credit funds also take out debt from creditors (also referred to a fund-level leverage, meaning leverage that is issued to the funds and guaranteed by investments and LP commitments in those funds). That is to say, instead of extending credit to borrowers, they become the borrower and take on leverage in their private credit business. But - why?

The principles are the same - to increase returns. Since these loans are secured by 50-100+ borrowers, they are well diversified, pose less risk, and thus are extended at lower pricing. For example, if the private credit fund can potentially borrow at S+275 at the fund-level, and use those funds to issue loans priced at S+500-650, they can capture the spread between the two. Even better, they don’t have to give any additional returns back to the creditors who are writing these S+275 loans outside of the principal and interest - which increases the returns of the fund for LPs (and increases the carried interest pool). As a reminder, LPs in debt funds typically receive 80-90% of the total return of the fund, with the remaining 10-20% of fund return going to the general partner (GP) in the form of carried interest (10% carried interest is much more common than 20%, particularly in senior-only/direct lending funds). Think of the general partner as the team managing the funds, which fills the pockets of the MDs and VPs who have carried interest as part of their compensation packages.

This is our sneaky way of introducing you to the leveraged loan market. These are called leverage loans because the loans that are being issued also have loans taken out against them, creating a bit of a f*cked up system where credit failures in one area can ricochet through the market. But it’s in effect the foundation of credit markets and so long as things go well, everyone makes money - all according to their risk tolerance.

Considerations When Employing Leverage

It’s important to remember that things don’t always go well, and leverage can be disastrous when used imprudently. While leverage can amplify returns, it also magnifies downside risk. As a basic guide, here are a few considerations when employing leverage and determining an appropriate capital structure:

Debt Servicing: Leverage introduces interest payments and principal repayments, which increase the financial obligations of the borrower. These costs reduce the cash flows of businesses, which can be restrictive to borrowers, especially during economic downturns or periods of financial stress.

Sensitivity to Market Conditions: Leverage exposes investments to greater sensitivity to market changes. Changes in interest rates, credit spreads, and other macroeconomic factors can impact the cost of borrowing and the ability to refinance debt. Since most loans in the private credit industry are issued as floating rate loans, increases in base rates (i.e. SOFR) directly increase the cost of borrowing, which reduces cash flow further.

Covenant Compliance: Leveraged investments come with specific financial covenants and restrictions. If borrowers fail to comply with these covenants (whether intentionally or unintentionally), penalties can be imposed, which range from restrictions on further borrowing, higher interest, and in the event of default/bankruptcy, asset seizure.

In Summary…

We know that was a lot - so let’s sum up. While both private equity and private credit firms use leverage, there are notable differences in the approach. Private equity is seeking to enhance returns, reduce capital at risk, and facilitate the acquisition of operating companies. Private credit uses leverage to increase their availability of capital to issue loans, and improve returns by lending at higher rates than they are borrowing. Both are focused on how much leverage can be employed to optimize returns, without becoming overly restrictive and increasing the risk of default/bankruptcy. Remember, the greater the risk, the greater the return - but that’s a sword that cuts both ways.

How did you feel about today’s post? Let us know in the comments. Remember that it takes time learning the ins and outs of this industry, and we’ll be writing about it every step of the way. You have to start somewhere.

Consider subscribing if you haven’t already (it’s free!). If you are an existing subscriber, consider upgrading to paid to support our team.

Good luck and happy hunting.

-OLB

Let us know what you thought about today's post in the comments! Any questions? We're here to engage.